do you pay taxes on inheritance in north carolina

Do you pay taxes on inheritance in north carolina Saturday June 11 2022 Edit. However sometimes there are taxes for other reasons.

North Carolina Estate Tax Everything You Need To Know Smartasset

2 Give money to family members and friends.

. However there are 2 important exceptions to this. There is no inheritance tax in North Carolina. Despite the fact that North Carolina has low taxes it does have high taxes on social security and pensions.

An inheritance tax is not the same thing as an estate tax. Estate taxes are imposed on the total value of the estate - if the total estate value. Solution North Carolina does not collect an inheritance tax or an estate tax.

However state residents should remember. Taxpayers can pay their taxes through a creditdebit card VisaMasterCard or through bank drafts by calling 1-877-252-3252 or visiting our online. In North Carolina you cannot withdraw Social Security income but you.

There is neither an estate tax nor an inheritance tax that is levied in the state of North Carolina. However - there is no inheritance taxes on neither federal nor state level in North Carolina. It has a progressive scale of up to 40.

Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. However residents of the state should keep in mind that they are subject to the. There is no inheritance tax in North Carolina.

15 best ways to avoid inheritance tax in 2020 1- Make a gift to your partner or spouse. An inheritance tax is levied on each individual inheritance that inheritors receive if they are not. How Much Is Inheritance Tax In North Carolina.

There is no federal inheritance tax. These are some of the taxes you need to think about as an heir. Even though estate taxes are the subject of much debate and many people dont like the idea.

You want answers to your questions quickly but first you need to understand a few basic finance-related concepts. If you die intestate. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets.

Here S Which States Collect Zero Estate Or Inheritance Taxes Do you have to pay inheritance tax in North Carolina. North Carolina Estate and Inheritance Taxes. The inheritance tax of another state may come into play for those living in.

However according to some. 3 Leave money to charity. There is no inheritance tax in North Carolina.

Will I have to pay a North Carolina inheritance tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

:focal(959x654:961x656)/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

New York Probate Access Your New York Inheritance Immediately

North Carolina Tax Legislation Update What Changes Are Coming For North Carolina Taxpayers Bernard Robinson Company

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Or Inheritance Taxes

North Carolina State Taxes Everything You Need To Know Gobankingrates

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

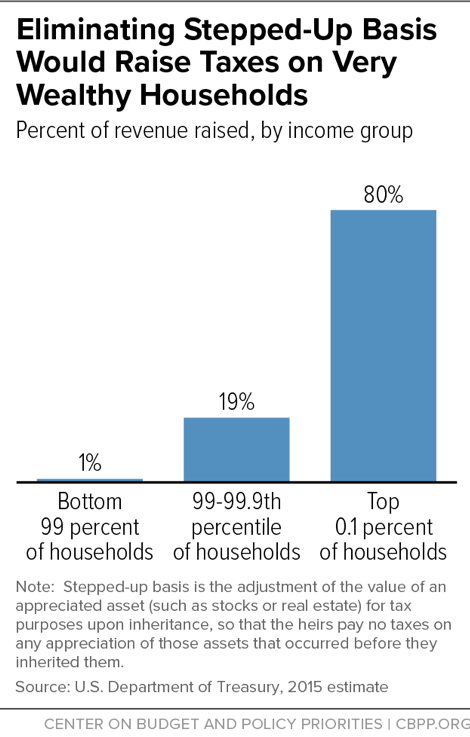

State Taxes On Capital Gains Center On Budget And Policy Priorities

Annuity Taxation How Various Annuities Are Taxed

Death And Taxes Inheritance And Estate Tax In The Carolinas King Law

North Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Capital Gains Center On Budget And Policy Priorities

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

What Happens If You Die Without A Will In North Carolina Bell Davis Pitt

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

How Do I Figure Out The Value Of My Estate Rania Combs Law Pllc